Accounting and Financial Reports

Accounting and Financial Reports

Business reports play a vital role in regularly tracking and measuring a company’s financial performance. They provide actionable insights on various aspects of the business and help you make confident business decisions. There are different types of business reports such as accounting reports and registers, inventory reports and statements, reports related to finance etc., providing specific details about various aspects of the business. Give this section a read, and find out different business reports and their benefits.

Related Articles

Tally Solutions |Updated on: January 16, 2024

The world of business revolves around two key concepts: profit and profitability. You could believe they’re the same thing, but wait.

Consider this—profit is the money left in your pocket after paying your bills. Then, what about profitability?

That’s the smart game—making your money work for you, creating returns on every dime you put in. These terms are frequently used in the same sentence, even though they are not the same. We’ll reveal the true difference between profit and profitability in this article, allowing you to look past the figures and propel your business ahead.

| “Profit vs. Profitability: Unveiling the True Difference and Unlocking Financial Success” |

Profit vs. profitability

Understanding the intricacies between profit and profitability in company finance is like decoding a complex code. These phrases frequently overlap, but they are not twins; they are jigsaw pieces from separate sets.

Let’s start with profit—it is the clear figure that appears when your revenue exceeds your costs. The score on the board is visible proof of your financial success. Isn’t it very clear?

Instead of focusing on a single figure, focus on profitability and a strategic approach. It’s a complicated financial chess game in which you arrange your resources to maximize rewards. Consider this: A company may be prosperous without being loaded with cash by investing intelligently for a better tomorrow.

What is the most important takeaway? Profit catches a snapshot, whereas profitability provides a picture of your financial strategy’s terrain. So, the next time these phrases cross your path, remember that profit represents your current situation, and profitability illuminates your financial future.

What exactly is profit?

Simply described, it is the money a company has left over after paying its bills. It’s more than just a figure; it’s that gold nugget of your financial journey, which is sitting at the bottom of your income statement. However, its relevance goes beyond this fundamental distinction. Profit is more than just fundamental viability; it is the foundation that allows businesses to pursue expansion, innovation, and long-term success.

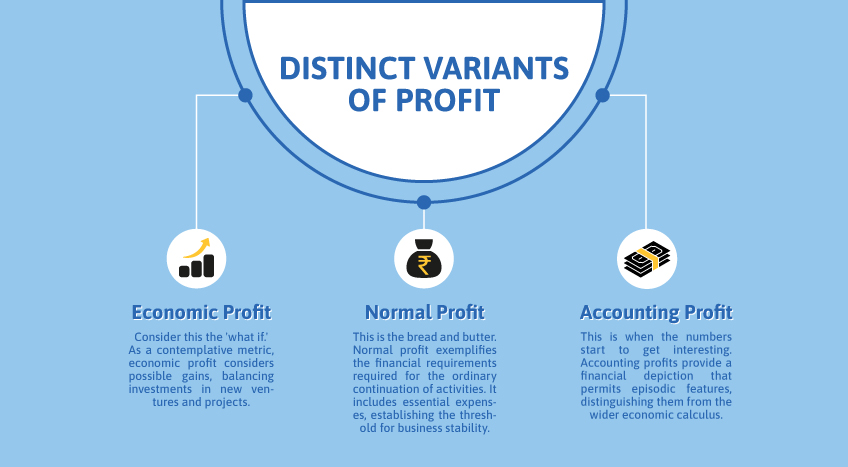

Let us now dive further. Let us look at the distinct variants of profit:

Cum et essent similique. Inani propriae menandri sed in. Pericula expetendis has no,

quo populo forensibus contentiones et, nibh error in per.Denis Robinson

As your budget progresses and evolves, continue referring to your SMART objectives. Stay focused and remember your goals – they will always inform what your next step will be!